Food from the Cloud

Food delivery business is on the rise making way for a new restaurant model: cloud kitchens. These warehouse facilities may be the restaurants of the future.

- Introductions

WHAT IS A CLOUD KITCHEN?

Also referred to as ghost kitchens, virtual kitchens, commissary kitchens, or dark kitchens. This type of restaurant development goes by many names, but all are referencing a new model which is a restaurant with no storefront that operates solely through delivery. For the sake of consistency, we will refer to these restaurant unicorns as “cloud kitchens”.

TOP FOOD DELIVERY SERVICE APPS

A New Kind of Kitchen is on the Rise

Despite the substantial investment required in real estate, leasehold improvements, and kitchen equipment, restaurants in the United States face a 60% chance of failure in their first year; this along with major advancements in technology and economic pressures from the global pandemic have created a catalyst for a hard reset of the restaurant industry.

In the report “Is the Kitchen Dead?” by UBS, it is estimated that the online food delivery market will grow 10x in the next ten years, from $35 billion currently to $365 billion by 2030. The U.S. restaurant industry is worth $556B with over 700,000 physical locations. Off-premise restaurant sales account for 38% of total restaurant sales.

This $198 billion segment is broken into 3 categories:

In 2019, restaurant delivery sales saw a 46% year over year growth. The average annual increase in delivery sales has historically been around the 20% mark. This increase is being driven by the multitude of food delivery apps with a constant influx of new competitors all trying to get a slice of the pie… I hope you like food puns.

Many restaurants see the rise in cloud kitchens as a competitor, however, cloud kitchens will be pulling market share from grocery chains rather than the local bistros. On any given day in the U.S., 6% of the entire country will be eating take-out for one meal or another. As many of us can attest during this pandemic, that our take-out and delivery habits have become amplified. Consumer habits will continue to change and it’s expected that restaurant delivery will continue to increase in a post-pandemic society.

Top Delivery Providers by Market (Jan 2020)

Nationwide (U.S.)

Houston

Dallas-Fort Worth

- Our Vision

Diverse Perspectives

Method Architecture is a Native American-owned, HUB-certified minority business that values diversity in every aspect of our work. We believe that diversity in thought, design, and project teams leads to more innovative and inclusive solutions for our clients, ensuring that each project we undertake is enriched by a variety of perspectives and experiences. This commitment allows us to deliver designs that truly resonate with and benefit the communities we serve.

Creating Efficiencies & Opportunities for Expansion

As many restaurateurs look for new opportunities to expand their businesses, dark kitchens provide an easy way for existing restaurants to increase sales volume without overwhelming staff or altering their physical location.

Efficiencies in Real Estate

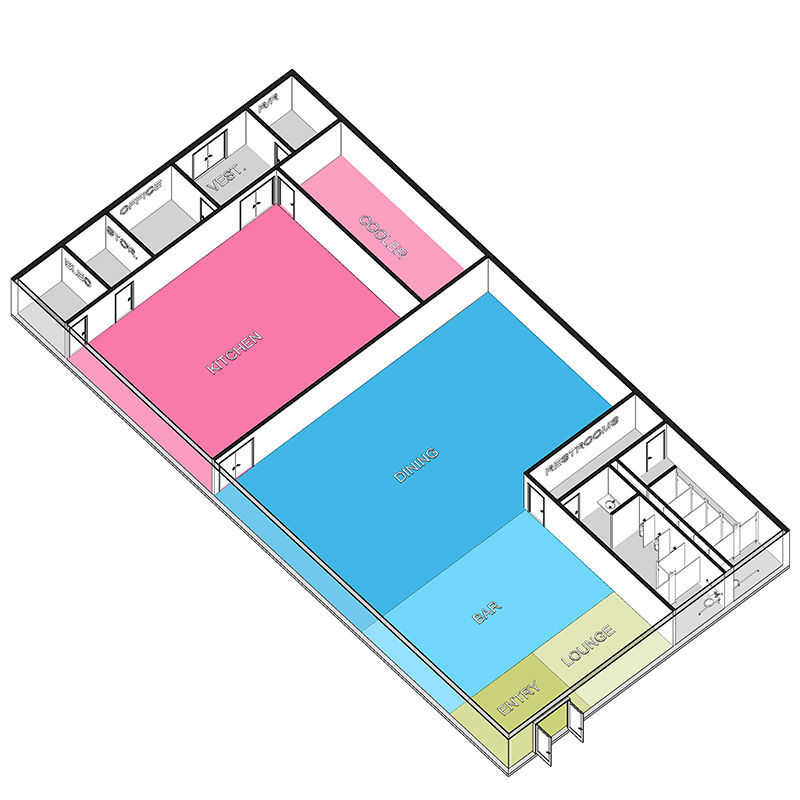

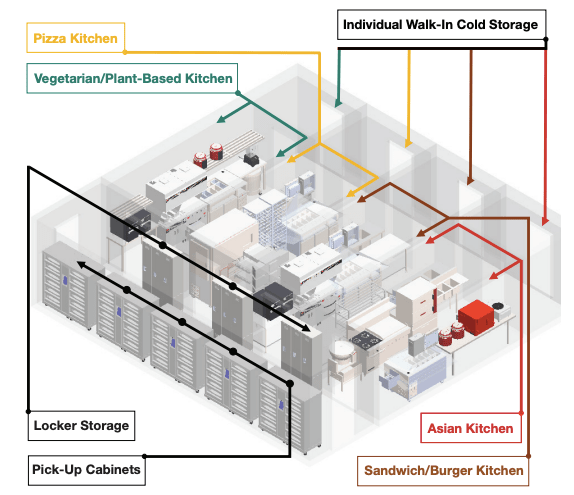

Ghost kitchens also offer many efficiencies for both restaurateurs and landlords compared to the traditional restaurant model. Below is a comparison of the same 2,000 square foot building footprint with two different scenarios: traditional dine-in restaurant and a cloud kitchen. The business models of both ghost kitchens and traditional, dine-in establishments differ in terms of start-up costs and operational expenses such as location, logistics, staffing, and licenses. Let’s look at how these two stack up:

TRADITIONAL RESTAURANT

CLOUD KITCHEN

LOCATION

Location and visibility are key to dining in restaurants. These businesses need easy access to population or need to be located in the cross-hairs of major traffic arteries which ultimately increases land and property costs.

The location for cloud kitchens is less about being visible from major roadways and more about access to population. Very similar to the strategy of last-mile facilities, cloud kitchens follow rooftops as they need to be in a delivery radius to customers.

STARTUP COSTS

Opening an average size restaurant takes approximately $600k-$1M in Texas, not including land costs. From kitchen equipment and furniture to technology and business licenses, the tab for starting your own restaurant can add up quickly.

Cloud kitchens cost roughly $2-4k a month depending on the market to run and are turn-key with little risk in overhead costs. Costs may vary depending on whether the operator provides kitchen equipment or just a white box kitchen space.

STAFFING

It takes a village to run a dine-in restaurant. From host staff to waitstaff and chefs to bartenders, overhead is a large and necessary cost for providing a great dining experience. The number of people a restaurant needs fluctuates depending on size and other variables.

In a cloud kitchen, the staff is limited to the number of kitchen staff needed to support the operation. This is usually a head chef, 1-2 junior chefs, and someone to help with food prep. Housekeeping, maintenance, and delivery liaisons are often a shared resource in cloud kitchens, similar to the setup in a coworking office.

PROFIT MARGINS

The average profit margin for a typical restaurant establishment ranges anywhere from 3-6 percent.

A cloud kitchen model is much more profitable in comparison with proft margins ranging in the 15-20% range.

FOR LANDLORDS

For traditional restaurant tenants, these spaces are very customized and often take a lot of effort and capital to make ready for a new tenant. Restaurants face a 60% chance of failure in their first year, creating more risk for landlords. Many restaurant properties are also standalone buildings with high parking counts, an inefficient use when real estate costs are high.

Where a traditional restaurant only has one tenant, cloud kitchens often have multiple restaurants operating out of one facility creating less risk when one tenant needs to move out. Since the facilities are solely commercial kitchens, the make ready for a new tenant is also minimal. Exterior improvements for cloud kitchens are often minimal where traditional restaurant tenants may want new windows, customized signage, or other improvements for curb appeal.

Opportunity Zones

If you’ve been living in a cave for the past few years, opportunity zones are areas in which the state federal government have agreed to provide a range of financial incentives for developers to redevelop areas in an effort to spur economic growth in this areas. While traditional retail may shy away from these areas, they’re prime for a concept like cloud kitchens because of its non-consumer facing model as well as access to local labor.

Test Kitchens for Out-of-Market Brands

Much of the risk for regional chains such as Whataburger™ or In’N’Out™ is that the market may be too saturated or their products won’t fit with the customer demographic. Rather than spending lots of capital on a pilot restaurant, brands can use cloud kitchens as a test kitchen to gauge interest with local consumers.

Sharing the Pie

Most restaurants see the rise in cloud kitchens as a competitor, however, cloud kitchens will be pulling market share from grocery chains rather than the local bistros. Cloud kitchens are a new avenue for existing restaurants to scale volume and remove the delivery aspect from their experiential dine-in concept.

Experience is Still King

Brick and mortar restaurants will always exist to provide a dining experience. As we’ve seen a huge shift to experiential in every other facet of retail, this aspect will become increasingly more important throughout the restaurant industry. Consumers want hyper-local dining experiences where the focus is on authenticity and quality.

TYPES OF CLOUD KITCHENS

Commissary (Aggregator) Kitchen

We have designed over 25 successful breweries and distilleries across the United States including Karbach Brewing Co., Yellow Rose Distillery, and Buffalo Bayou Brewing Co.

From interior build-outs and ground-up breweries to tap rooms and packaging facilities, we have helped our clients at every stage of their journey from home brewing to national distribution.

Delivery App Kitchen

Most similar to the commissary kitchen, however, these facilities are operated by a sole delivery app like UberEats or Grubhub. The advantage to the business owner is that they receive premium benefits when selling their items through the app, but are limiting their exposure to only a single apps’ user base.

This is a great option for startup restaurants with little capital or customer base who needs the app to drive traffic and provide marketing channels.

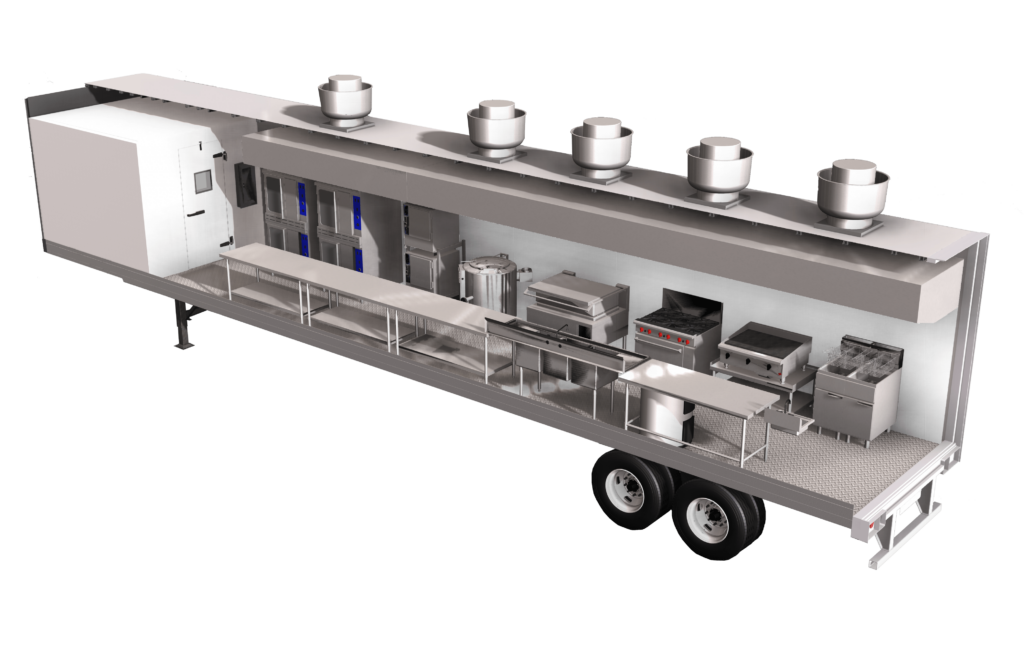

Pod, Container, or Mobile Cloud

These are small containers, often renovated shipping containers or trailers, that can be placed in any location, such as parking lots. Due to their size and mobile nature, they are easy to set up and operate, however, this model has had its share of controversy around cleanliness and work conditions for employees.

This option would be ideal for those brands entering a new market where an aggregator or delivery app kitchen is not yet present. This is also an option for local brick and mortar restaurants who want to expand their delivery zones to other parts of town.

Independent Kitchen

The independent kitchen model is a standalone kitchen with no offline presence. They can deliver the product themselves, through a delivery app, or through both.

This model has been used by the catering industry for decades, but with new delivery services has created a renewed opportunity for both caterers and restaurants to open their own “kitchen only” establishment.

Hub & Spoke Model

In the hub and spoke model, a central kitchen prepares the food, and then semi-cooked dishes are shipped to final smaller outlets where they need to be cooked before shipping. Traditionally, this has been used by corporate kitchens for fast food chains. The advantage is the cost-savings due to scale and standardization.

Pick-Up Only

This is a concept to keep an eye on. The concept and driving factor behind cloud kitchens is the convenience of delivery. However, Starbucks has launched a few pick-up only concepts in dense metros like New York City and Chicago, but this may be an anomaly due to the popularity of the mobile ordering function on their proprietary app.

The Take Out Tech of Tomorrow

The evolution in technology and AI is giving rise to new innovations that will make food delivery more seamless.

Self-driving Cars

Automobile manufacturers and fast food chains are pairing up to bring autonomous delivery vehicles to reality.

- Pizza Hut partnered with Toyota to develop a zero-emissions truck with an automated kitchen and has also partnered with Accenture and Visa to create an in-car pizza ordering system.

- Ford and Domino’s Pizza have teamed up and are currently testing self-driving pizza delivery cars

Robots & Drones

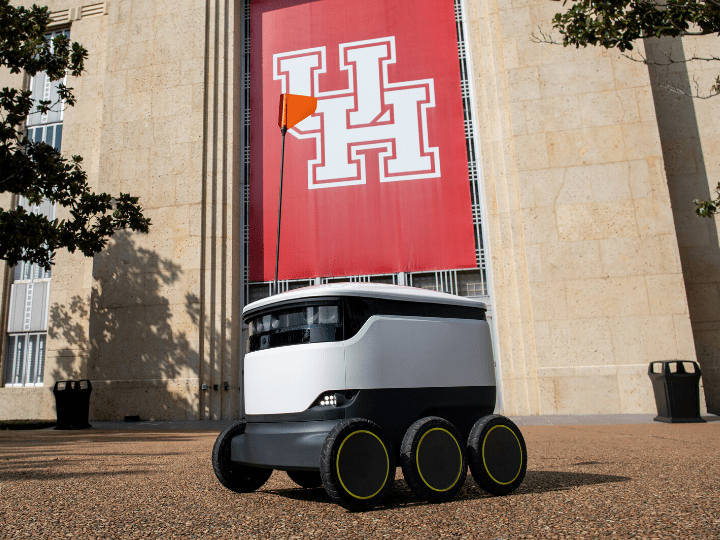

Major e-commerce as well as a few food companies have been testing robot and drone deliveries.

- At the University of Houston, Chartwells Higher Education has partnered with Starship Deliveries to deploy a fleet of 30 meal delivery robots to deliver food from campus dining facilities to students around campus. The robots can carry up to 20 lbs. or the equivalent of about 3 bags of groceries.

Sources